Choose the one alternative that best completes the statement or answers the question. Solve the problem.

STION 1

Choose the one alternative that best completes the statement or answers the question. Solve the problem.

Prepare a balance sheet for Mullen’s Hardware for December 31 of last year. The company assets are cash $15,000, accounts receivable $21,000, and merchandise inventory $95,000. The liabilities are accounts payable $12,000 and wages payable $17,000. The owner’s capital is $102,000.

|

Mullen’s Hardware Balance Sheet Total assets: $131,000 Total liabilities: $29,000 Total liabilities and owner’s equity: $131,000 |

|

Mullen’s Hardware Balance Sheet Total assets: $131,000 Total liabilities: $12,000 Total liabilities and owner’s equity: $131,000 |

|

Mullen’s Hardware Balance Sheet Total assets: $95,000 Total liabilities: $12,000 Total liabilities and owner’s equity: $102,000 |

|

Mullen’s Hardware Balance Sheet Total assets: $131,000 Total liabilities: $17,000 Total liabilities and owner’s equity: $17,000 |

10 points

QUESTION 2

Solve the problem. Express answers as a percent rounded to the nearest tenth.

Complete a vertical analysis on the balance sheet for Mullen’s Hardware for December 31 of last year. The company assets are cash $11,000, accounts receivable $40,000, and merchandise inventory $96,000. The liabilities are accounts payable $19,000 and wages payable $25,000. The owner’s capital is $103,000.

|

Mullen’s Hardware Balance Sheet Cash: 7.5% Accounts receivable: 27.2% Merchandise inventory: 65.3% Total assets: 100% Accounts payable: 43.2% Wages payable: 17.0% Total liabilities: 29.9% Mullen’s capital: 70.1% Total liabilities and owner’s equity: 100% |

|

Mullen’s Hardware Balance Sheet Cash: 7.5% Accounts receivable: 27.2% Merchandise inventory: 65.3% Total assets: 100% Accounts payable: 12.9% Wages payable: 56.8% Total liabilities: 29.9% Mullen’s capital: 70.1% Total liabilities and owner’s equity: 100% |

|

Mullen’s Hardware Balance Sheet Cash: 7.5% Accounts receivable: 27.2% Merchandise inventory: 65.3% Total assets: 100% Accounts payable: 12.9% Wages payable: 17.0% Total liabilities: 29.9% Mullen’s capital: 70.1% Total liabilities and owner’s equity: 100% |

|

Mullen’s Hardware Balance Sheet Cash: 7.5% Accounts receivable: 27.2% Merchandise inventory: 65.3% Total assets: 100% Accounts payable: 43.2% Wages payable: 56.8% Total liabilities: 100% Mullen’s capital: 70.1% Total liabilities and owner’s equity: 100% |

10 points

QUESTION 3

Solve the problem. Express answers as a percent rounded to the nearest tenth.

Complete a vertical analysis on the balance sheet for Jake’s Janitorial Service for December 31 of last year. The company assets are cash $20,000, accounts receivable $48,000, merchandise inventory $89,000, and equipment $82,000. The liabilities are accounts payable $13,000, wages payable $16,000, and mortgage note payable $77,000. The owner’s capital is $133,000.

|

Jake’s Janitorial Service Balance Sheet Cash: 8.4% Accounts receivable: 20.1% Merchandise inventory: 37.2% Equipment: 34.3% Total assets: 100% Accounts payable: 12.3% Wages payable: 15.1% Mortgage note payable: 32.2% Total liabilities: 44.4% Jake’s capital: 55.6% Total liabilities and owner’s equity: 100% |

|

Jake’s Janitorial Service Balance Sheet Cash: 8.4% Accounts receivable: 20.1% Merchandise inventory: 37.2% Equipment: 34.3% Total assets: 100% Accounts payable: 5.4% Wages payable: 6.7% Mortgage note payable: 72.6% Total liabilities: 44.4% Jake’s capital: 55.6% Total liabilities and owner’s equity: 100% |

|

Jake’s Janitorial Service Balance Sheet Cash: 8.4% Accounts receivable: 20.1% Merchandise inventory: 37.2% Equipment: 34.3% Total assets: 100% Accounts payable: 12.3% Wages payable: 15.1% Mortgage note payable: 72.6% Total liabilities: 100% Jake’s capital: 55.6% Total liabilities and owner’s equity: 100% |

|

Jake’s Janitorial Service Balance Sheet Cash: 8.4% Accounts receivable: 20.1% Merchandise inventory: 37.2% Equipment: 34.3% Total assets: 100% Accounts payable: 5.4% Wages payable: 6.7% Mortgage note payable: 32.2% Total liabilities: 44.4% Jake’s capital: 55.6% Total liabilities and owner’s equity: 100% |

10 points

QUESTION 4

Solve the problem.

For the month ending June 30, TriCounty Nursery has net sales of $251,000, cost of goods sold of $99,000, and operating expenses of $70,000. Find the gross profit and net income.

|

gross profit: $152,000; net income: $82,000 |

|

gross profit: $72,100; net income: $29,000 |

|

gross profit: $82,000; net income: $152,000 |

|

gross profit: $152,000; net income: $29,000 |

10 points

QUESTION 5

Solve the problem.

For the month ending December 31, MidState Machinery had gross sales of $4,207,000, returns of $68,800, cost of beginning inventory $502,000, cost of purchases $1,484,000, cost of ending inventory $570,000, total operating expenses $135,900. Find the net sales and cost of goods sold.

|

net sales: $4,207,000; cost of goods sold: $1,416,000 |

|

net sales: $4,138,200; cost of goods sold: $1,416,000 |

|

net sales: $4,138,200; cost of goods sold: $135,900 |

|

net sales: $4,138,200; cost of goods sold: $2,716,300 |

10 points

QUESTION 6

Solve the problem. Express answers as a percent rounded to the nearest tenth.

The Garden Shop had a cost of goods sold of $108,000, operating expenses of $49,000, and net sales of $272,000. Find the cost of goods sold percent of net sales and operating expenses percent of net sales.

|

cost of goods sold percent of net sales: 39.7%, operating expenses percent of net sales: 21.7% |

|

cost of goods sold percent of net sales: 21.7%, operating expenses percent of net sales: 39.7% |

|

cost of goods sold percent of net sales: 18.0%, operating expenses percent of net sales: 39.7% |

|

cost of goods sold percent of net sales: 39.7%, operating expenses percent of net sales: 18.0% |

10 points

QUESTION 7

Solve the problem. Express answers as a percent rounded to the nearest tenth.

Speedy Cleaning Service had a cost of beginning inventory of $40,000, net sales of $222,000, and gross sales of $401,000. Find the beginning inventory percent of net sales and gross sales percent of net sales.

|

beginning inventory percent of net sales: 180.6%, gross sales percent of net sales: 18.0% |

|

beginning inventory percent of net sales: 18.0%, gross sales percent of net sales: 180.6% |

|

beginning inventory percent of net sales: 65.3%, gross sales percent of net sales: 18.0% |

|

beginning inventory percent of net sales: 18.0%, gross sales percent of net sales: 65.3% |

10 points

QUESTION 8

Solve the problem. Round to the nearest tenth.

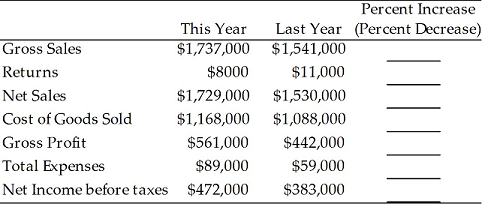

Find the percent increase (or decrease) in net sales from last year to this year for the income statement.

|

10.6% decrease |

|

10.6% increase |

|

10.3% increase |

|

10.3% decrease |

10 points

QUESTION 9

Solve the problem. Round to the nearest tenth.

Find the percent increase (or decrease) in cost of goods sold from last year to this year for the income statement.

|

50.8% increase |

|

7.4% decrease |

|

50.8% decrease |

|

7.4% increase |

10 points

QUESTION 10

Solve the problem.

Prepare a balance sheet for Jake’s Janitorial Service for December 31 of last year. The company assets are cash $16,000, accounts receivable $58,000, merchandise inventory $50,000, and equipment $97,000. The liabilities are accounts payable $23,000, wages payable $22,000, and mortgage note payable $87,000. The owner’s capital is $89,000.

|

Jake’s Janitorial Service Balance Sheet Total assets: $221,000 Total liabilities: $110,000 Total liabilities and owner’s equity: $89,000 |

|

Jake’s Janitorial Service Balance Sheet Total assets: $221,000 Total liabilities: $132,000 Total liabilities and owner’s equity: $89,000 |

|

Jake’s Janitorial Service Balance Sheet Total assets: $221,000 Total liabilities: $132,000 Total liabilities and owner’s equity: $221,000 |

|

Jake’s Janitorial Service Balance Sheet Total assets: $124,000 Total liabilities: $132,000 Total liabilities and owner’s equity: $89,000 |

10 points

Click Save and Submit to save and submit. Click Save All Answers to save all answers.

Answer

Get this answer with Chegg Study

Needs help with similar assignment?

We are available 24x7 to deliver the best services and assignment ready within 3-12 hours? PAY FOR YOUR FIRST ORDER AFTER COMPLETION..